Dec 15, 2025

Best Digital Wallets for African Creators in 2026: What to Use, Why It Matters, and How to Choose Right

Discover the best digital wallets for African creators in 2026. Compare Endow Wallet, Selar, Grey, Payoneer, Chipper Cash, and more. Learn how to choose the right wallet to manage USD and NGN income, track revenue, and build sustainable creator finances.

By 2026, most African creators aren’t struggling because they lack talent.

They’re struggling because money moves faster than their systems.

Income doesn’t arrive as a single paycheck.

It comes in fragments.

Pieces that don’t talk to each other.

A YouTube payout this month.

A brand deal paid late.

Course sales spread across platforms.

Affiliate income that looks good on paper but shrinks after conversion.

A client who pays in dollars, another who insists on local currency.

All of this happens while you’re still expected to create consistently, negotiate professionally, plan content, and somehow stay calm about money.

That pressure is new. And it’s structural, not personal.

This is why digital wallets are no longer a “finance nerd” topic.

They’ve become part of a creator’s survival kit.

The wallet you choose determines:

how fast you get paid

how much value you lose to conversion

how clearly you understand your income

how prepared you are for taxes, slow months, or emergencies

This guide isn’t about hype or trends.

It’s about how money actually moves for African creators in real life and how to stop losing control of it.

Why traditional banks fail creators

Traditional banks weren’t built with creators in mind.

They were built around assumptions that simply don’t apply anymore.

A traditional bank account assumes:

a stable monthly salary

predictable deposits

one currency

mostly local transactions

minimal income variation

Creator income breaks every one of those assumptions.

A creator might earn five different ways in one month and nothing the next.

They might earn in dollars today and naira tomorrow.

They might need to receive money from platforms that don’t even support local banks directly.

This mismatch creates constant friction.

Creators need wallets that can:

receive money globally

handle multiple currencies without forcing conversion

connect to selling platforms and payout systems

move money quickly when needed

clearly show where income is coming from

If your wallet can’t do this, you’ll always feel behind.

Even when the numbers look “good”.

The main types of digital wallets African creators use

Before naming tools, it’s important to understand categories.

This is where many creators go wrong. They expect one wallet to do everything.

In reality, wallets are designed for different jobs.

1. Virtual dollar (foreign currency) wallets

These wallets allow creators to receive and hold currencies like USD, GBP, or EUR.

They are essential if you:

earn from YouTube, TikTok, Spotify, Substack

work with international brands or clients

want to protect value in volatile currency environments

Their biggest strength is access.

They let you participate in the global creator economy.

Their limitation is that they are often not built for everyday spending or full financial management.

They are powerful holding tools, not complete systems.

2. Multi-currency digital wallets

These wallets let you hold, convert, and move between multiple currencies.

They’re useful if:

you earn from different regions

you collaborate across borders

you need flexibility in how and when you convert

This is where fees become dangerous.

A small FX spread looks harmless until you realise how much it eats over time.

Creators who don’t track this quietly lose a meaningful percentage of their income.

3. Local digital wallets and neobanks

These wallets are best for:

local transfers

everyday spending

subscriptions and bills

paying collaborators

They are necessary, but they are rarely enough on their own.

Most are not designed to receive foreign income directly.

They are best used as endpoints, not starting points.

Smart creators combine local wallets with foreign currency wallets instead of forcing one tool to do everything.

What makes a wallet truly creator-friendly

Not every wallet that works for freelancers or traders works for creators.

Creators have unique needs.

They earn irregularly, from many sources, often across borders, and with delayed payments.

A creator-friendly wallet usually has:

support for international payments

clear transaction history (not cryptic references)

fast, predictable withdrawals

reasonable conversion fees

exportable records for tracking and taxes

minimal surprise freezes

support that actually responds

Creators don’t need fancy features.

They need reliability and clarity.

When money feels invisible, anxiety grows.

When money is visible, decisions improve.

Why wallet choice is a survival decision

In 2026, the difference between struggling creators and sustainable ones is rarely talent.

It’s structure.

Creators fail not because they don’t work hard, but because:

income stays fragmented

expenses creep up unnoticed

delays cause panic

conversion losses aren’t tracked

financial decisions are reactive

A good wallet doesn’t just move money.

It reduces mental load.

It lets you answer questions like:

How much did I actually earn this quarter?

Can I afford to slow down next month?

How much is safe to withdraw now?

What part of my income is stable?

Without guessing.

The best digital wallets for African creators in 2026

Creators in Africa currently rely on a mix of tools, each solving a different problem.

Some wallets are good at receiving money.

Some are good at spending it.

Very few are good at managing it.

This is where the distinction between movement and management becomes important.

Endow Wallet — full breakdown (why it’s a creator income hub)

What it is, in one line:

Endow Wallet is a creator-first wallet + financial layer that lets you receive, organise, sell, split and move money in USD and NGN, while attaching revenue context to every transaction.

Why that matters

Most wallets stop at “receive.” Endow aims to stop the guessing after you receive. It gives you visibility, product/payment integrations and simple payout automation so creators aren’t rebuilding the same spreadsheet every month.

Core features creators will actually use

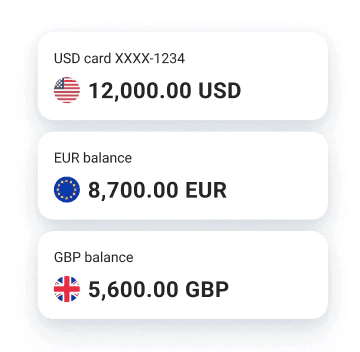

USD + NGN sub-accounts: receive in foreign currency and local currency without forced conversion. Protects value and gives choice when to convert.

Set-as-payout on platforms: use Endow wallet details for course platforms, marketplaces, sponsorship payouts. One place to point all incoming flows.

Revenue tracking & reports: transactions are tagged by income source (sales, platform, sponsorship) so your quarter report is not guesswork.

Sell products & memberships: native checkout + wallet settlement means you get product revenue into the same dashboard.

Automated payouts & split payments: pay collaborators or split revenue on sales automatically, no manual math or missed transfers.

Exports & tax-ready statements: download CSVs for bookkeeping and tax filing.

Withdrawal rules: set thresholds or scheduled transfers to your bank to avoid impulse conversions or high FX windows.

Typical creator workflow (example)

Create product page or connect YouTube/Substack payout to Endow.

Sales and platform payouts land in USD sub-account.

Endow auto-tags each deposit (YouTube, course sale, brand).

You decide: keep USD in wallet, convert 25% weekly, or schedule monthly transfer to NGN bank.

Endow automatically splits 20% of course revenue to your editor, transfers to their wallet, and records the expense.

Security, verification & compliance

2FA, KYC verification for higher limit, exportable transaction logs, all essential for tax and to avoid account freezes.

Good wallets communicate changes to policy. Endow aims to warn users ahead of changes (this is a must-have; demand it elsewhere if not provided).

Pros

Built around creators' actual workflows: products + payouts + splits + revenue visibility.

Reduces mental overhead: one dashboard for multi-platform income.

Keeps value in USD where needed.

Cons / Watchouts

As a platform, onboarding takes a bit more time (KYC, connect platforms). But once set up, it saves many hours monthly.

If you rely only on Endow and it ever restricts your account, diversification matters and keep secondary payout methods for critical platforms.

Selar Wallet — seller-focused, works best if you’re in the Selar ecosystem

What it is:

Selar Wallet is the native settlement tool for creators who sell digital products and tickets on Selar.

Real use case

If your primary revenue is digital products sold on Selar (courses, ebooks, presets), the Selar Wallet is convenient: sales land quickly, and withdrawals are straightforward to local banks.

Pros

Seamless: no extra plumbing if you already sell there.

Fast product payout flow: product → Selar → your wallet → bank.

Cons / Limitations

Ecosystem lock-in. If you start selling elsewhere or get brand payments, you’ll still need another wallet.

Limited cross-platform visibility and reporting. Selar’s reporting focuses on Selar sales, not your total business.

Not ideal for holding USD or handling foreign platform payouts.

Best practice

Use Selar Wallet as a product sales ledger, and automatically move a portion of revenue into your Endow Wallet or local bank to consolidate reporting.

Grey — virtual USD access for creators who need foreign rails

What it is:

A virtual dollar account that lets creators receive USD from platforms or clients that don’t pay into local banks.

Real use case

You land a US brand deal or get YouTube/AdSense/affiliate funds, Grey gives you the receiving account details in USD and a simple way to withdraw or transfer.

Pros

Quick access to foreign currency rails.

Typically simpler KYC and easy sign-up.

Cons / Limitations

No native revenue management. It’s a holding point, not a finance OS.

You’ll likely need to move funds to another wallet or bank for spending/recording.

Watch FX spreads on conversion as many creators lose 3–7% on conversion if not careful.

Best practice

Use Grey strictly as a foreign receipts inbox. Move larger lumps into Endow (for tracking/splitting) or a virtual dollar emergency fund. Don’t leave all your working capital in Grey if you need liquidity in NGN.

Payoneer — the reliable global payout pipe for scale creators & marketplaces

What it is:

A mature payments provider used by marketplaces, ad networks and platforms to pay international creators and freelancers.

Real use case

If you work with established global marketplaces (course platforms, stock agencies, affiliate networks), Payoneer is often the supported payout method.

Pros

Wide global acceptance and stable rails.

Multi-currency options.

Good for creators who already operate at scale.

Cons / Limitations

Fees can be higher for small creators; there’s usually withdrawal and conversion costs.

Not creator-specific: no product sales integrations, no revenue tagging.

Best practice

If Payoneer is the only route for a particular platform, receive there but push a weekly or monthly transfer into Endow (or your central hub) to keep reporting consolidated. Treat Payoneer as a pipeline rather than the place you manage business accounting.

Chipper Cash — regional money, everyday spending & collaborator payments

What it is:

A fast, low-friction cross-border payment app across many African markets for quick transfers and receiving local cash.

Real use case

You’re paying a videographer in Ghana from Nigeria, or you need to receive quick local payments from community members, Chipper is simple and cheap for regional flow.

Pros

Low friction for transfers between African countries.

Great for paying teammates, contractors, or for micro-transactions.

Cons / Limitations

Not built for foreign platform payouts (USD inflows are limited).

Limited bookkeeping and product sales options.

Best practice

Use Chipper for operational cash like paying contractors, sending gifts, refunding attendees. Don’t use it as your primary revenue hub.

Eversend and similar transfer wallets - efficient FX and remittances

What it is:

Cross-border remittance and multi-currency wallets optimized for FX efficiency.

Real use case

You need to send/receive cross-border remittances cheaply, or you prefer holding multiple local currencies with better FX than your local bank.

Pros

Often competitive FX rates.

Good for one-off transfers or moving funds between regions.

Cons / Limitations

It is not a creator finance platform.

Some platforms restrict the types of transfers or impose limits that require higher KYC.

Best practice

Use Eversend for strategic transfers (paying international vendors, moving funds between regions). Pair it with Endow for bookkeeping and consolidated revenue view.

How creators stitch these tools into a real system

A single wallet rarely solves everything. The successful pattern for creators in 2026 is architecture, not loyalty.

Simple, practical configuration:

Primary hub: Endow Wallet (USD + NGN; revenue tracking; product & membership sales; automated splits)

Platform-specific receiver: Payoneer or Grey for platforms that require those rails

Product sales micro-hub: Selar for direct digital product sales when that’s a big channel

Regional ops: Chipper Cash for fast collaborator payments and regional transfers

Remittance & FX: Eversend for strategic cross-border conversion when rates matter

This reduces friction: Endow becomes the source of truth. Other wallets are specialist tools that feed into it rather than replace it.

Onboarding checklist (practical steps)

Verify KYC early on each wallet to avoid limits at critical times.

Set up auto-forwards where possible (platform → Grey/Payoneer → Endow).

Create tags and rules in Endow to label incoming funds by source.

Schedule weekly reconciliations (10–20 minutes) to move funds and check invoices.

Set thresholds in Endow for automatic conversion or transfers to your spending account.

Tips for Maintaining Control Over Your Income

Even with the best wallets, money management is only as good as the habits you build around it. For creators in 2026, discipline is less about spreadsheets and more about predictable routines.

Regular reconciliation: Set aside 10–20 minutes weekly to review transactions, confirm revenue tags, and ensure collaborators have been paid. A small habit prevents large surprises.

Set conversion rules: Decide in advance when to convert USD to NGN. Avoid impulsive conversions during market dips or spikes. Let your wallet work according to a plan, not panic.

Automate where possible: Use Endow’s split payment and auto-transfer features to reduce mental load. Automating routine tasks keeps your focus on creation.

Keep emergency buffers: Maintain a separate sub-account for unexpected expenses. Even a small safety net prevents disruption when income fragments or delays hit.

Monitor fees: FX spreads, platform fees, and transfer costs add up quickly. Track these as part of your regular review to know your true income.

Building a Creator Finance Stack That Scales

The best creators don’t just adopt wallets, they architect their financial ecosystem. By combining hubs like Endow with specialized tools (Payoneer, Grey, Selar, Chipper Cash, Eversend), you can:

Maintain global earning power without losing value to conversion

Gain full visibility over every revenue stream

Reduce mental load, freeing space for creativity

Pay collaborators seamlessly and transparently

Plan for taxes, slow months, and growth opportunities

Think of it as building a financial operating system for your creator business. Each tool has its role, but your central hub (Endow Wallet) keeps everything coherent.

Final Thoughts: Money Should Serve Your Creativity, Not the Other Way Around

2026 is not about earning more, it’s about seeing clearly, moving quickly, and staying in control. The creators who thrive are those who treat money like a system, not a stressor.

A digital wallet isn’t a luxury; it’s a survival tool. When chosen and configured properly, it becomes an extension of your creative workflow, giving you the clarity and stability to focus on what you do best: creating.

By combining global access, multi-currency flexibility, revenue visibility, and automation, Endow Wallet empowers African creators to finally tame the fragmented nature of income and build businesses that are both sustainable and scalable.