Jan 26, 2026

How to Create a Zero-Based Budget as a Creator

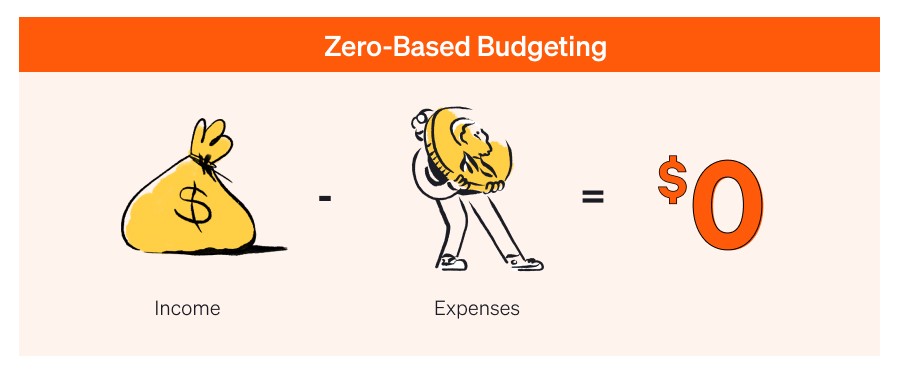

In a zero-based budget: Income minus expenses equals zero Savings, taxes, investments, and buffers are treated as expenses Nothing is “left over” by accident

For most creators, budgeting feels like a punishment.

Money comes in irregularly.

Income changes month to month.

Platforms pay late.

Brands delay transfers.

Some months feel abundant. Others feel like survival.

So creators either avoid budgeting entirely or follow traditional advice that simply doesn’t fit how the creator economy works.

Zero-based budgeting changes that.

Not by restricting you, but by giving every naira, dollar, or euro a job before it disappears.

This guide breaks down exactly how creators can build and run a zero-based budget, even with inconsistent income, multiple revenue streams, collaborators, and fluctuating expenses.

What Is Zero-Based Budgeting (In Plain Terms)?

Zero-based budgeting means:

Every unit of income you receive is assigned a purpose until your balance reaches zero.

That doesn’t mean you spend everything.

It means you decide what happens to your money before your money decides for you.

In a zero-based budget:

Income minus expenses equals zero

Savings, taxes, investments, and buffers are treated as expenses

Nothing is “left over” by accident

Every amount has a name.

Every category has intention.

Why Zero-Based Budgeting Is Perfect for Creators

Traditional budgeting assumes:

Fixed salary

Predictable monthly income

Few income sources

Clear employer deductions

Creators live in the opposite reality.

Creators deal with:

Irregular income

Multiple platforms

Delayed payouts

Revenue splits

High upfront costs

Sudden slow months

Zero-based budgeting works for creators because it:

Adapts to fluctuating income

Works per payout, not per month

Helps you plan before you earn again

Makes slow months less stressful

Prevents accidental overspending in high months

It is control without rigidity.

The Core Principle Creators Must Understand First

Before building your budget, you need this mindset shift:

You do not budget what you hope to earn.

You budget what has already arrived.

Creators often budget future income. That creates anxiety when payments delay or projections fail.

Zero-based budgeting starts only when money lands.

Every payout triggers a budgeting decision.

This is critical.

Step 1: Identify All Creator Income Streams

Before assigning money, you need visibility.

Creators rarely earn from one source. List every income stream, even small ones.

Examples:

Platform payouts (YouTube, TikTok, Substack)

Brand deals

Affiliate commissions

Digital products

Courses and workshops

Consulting

Community memberships

Tips and donations

Speaking engagements

Revenue shares

Why this matters:

Different income streams behave differently

Some are recurring, others seasonal

Some require collaborators

Some are taxable immediately

Zero-based budgeting requires income clarity before allocation.

Step 2: Separate Business Money From Personal Money

This step is non-negotiable.

If your creator income and personal spending live in the same place, zero-based budgeting will fail.

You need:

A creator business account

A personal spending account

Clear rules for transfers between them

Why?

Your creator income is not all yours to spend

Taxes, collaborators, tools, and reinvestment come first

Personal spending should be intentional, not accidental

Endow is designed to sit at this exact intersection, where creator income lands first, before it is split or spent.

Step 3: Define Your Budget Categories (Creator Edition)

Zero-based budgets fail when categories are vague.

Creators need categories that reflect how they actually operate.

Here’s a creator-specific framework:

1. Taxes

This is not optional.

Treat taxes as a bill you pay to your future self.

Many creators set aside:

20–30% depending on country and income structure

2. Operating Costs

These are the costs required to earn again:

Internet

Software subscriptions

Equipment

Hosting

Editing tools

Marketing tools

3. Team and Collaborators

Money that is not yours:

Editors

Designers

Writers

Co-creators

Revenue shares

This should be separated early to avoid spending it accidentally.

4. Reinvestment

Growth money:

Ads

Better equipment

Skill development

Courses

Experiments

5. Personal Pay

What you actually take home.

This is your salary, not what is left over.

6. Financial Buffer

Your safety net:

Emergency fund

Slow-month cushion

Income smoothing

Every category must exist before allocation begins.

Step 4: Allocate Income Until It Reaches Zero

This is where zero-based budgeting becomes real.

When money lands:

Record the exact amount

Assign percentages or fixed amounts to each category

Continue until the balance equals zero

Example:

You receive ₦1,000,000 from a brand deal.

Taxes: ₦250,000

Team payouts: ₦200,000

Operating costs: ₦100,000

Reinvestment: ₦150,000

Financial buffer: ₦150,000

Personal pay: ₦150,000

₦1,000,000 allocated.

₦0 unassigned.

No guessing later.

No guilt spending.

No surprise shortages.

Step 5: Budget Per Payout, Not Per Month

Creators don’t earn monthly.

They earn event-based.

Zero-based budgeting should be triggered by:

Each platform payout

Each brand payment

Each product sale batch

This removes stress during slow months because:

You already allocated during high months

Buffers are built intentionally

Personal pay is smoothed

Monthly budgeting works for salaries.

Event-based budgeting works for creators.

Step 6: Build a Creator Financial Buffer Inside the Budget

Most creators treat buffers as leftovers.

That is why slow months hurt.

In zero-based budgeting:

Buffer contributions are mandatory

They are planned

They happen before personal spending

Your buffer should aim to cover:

3–6 months of personal pay

Minimum operating costs

Team obligations

This is what converts volatile income into emotional stability.

Step 7: Track, Review, and Adjust Without Guilt

Zero-based budgets are not rigid.

They are responsive.

Every payout teaches you something:

Are taxes underestimated?

Are operating costs creeping?

Is personal pay realistic?

Is reinvestment working?

Adjust categories as your creator business evolves.

The goal is not perfection.

The goal is awareness and intention.

Common Mistakes Creators Make With Zero-Based Budgeting

Budgeting Future Income: This creates anxiety and false confidence.

Skipping Tax Allocation: This creates panic later.

Mixing Personal and Business Spending: This breaks visibility.

Forgetting Collaborators: This damages trust.

Treating Savings as Optional: This guarantees stress.

Zero-based budgeting only works when it is respected.

How Endow Makes Zero-Based Budgeting Practical for Creators

Zero-based budgeting requires:

Clear income visibility

Category-based allocation

Revenue splitting

Buffer creation

Clean records

Endow supports this by allowing creators to:

See all income streams in one place

Assign money to categories immediately

Split revenue before spending

Build buffers intentionally

Track creator finances without spreadsheets

Instead of budgeting in theory, creators budget in real time, when money lands.

This is the missing layer most creators struggle with.

Build a zero-based budget that actually fits creator income.

Track payouts, allocate intentionally, and plan for slow months with clarity.

Start building smarter with Endow

Zero-Based Budgeting Is Not About Restriction

It is about:

Predictability

Confidence

Control

Sustainability

Creators burn out financially not because they don’t earn enough, but because money moves without intention.

Zero-based budgeting gives your income direction.

Final Thoughts

Creators do not need stricter budgets.

They need smarter systems.

Zero-based budgeting works because it respects the reality of creative income while enforcing discipline without punishment.

When every payout has a job:

Stress reduces

Planning improves

Growth becomes intentional

Slow months stop feeling like failure

Money stops being emotional.

It becomes operational.